Inquire about group insurance Some firms offer decreases to vehicle drivers who get insurance policy through a team strategy from their companies, via professional, service as well as graduates groups or from other organizations. Ask your employer and also inquire with teams or clubs you belong to to see if this is possible.

Choose various other discount rates Business use price cuts to insurance policy holders who have not had any kind of crashes or moving offenses for a number of years. cheaper car insurance. You may additionally obtain a discount rate if you take a protective driving course. If there is a young motorist on the policy who is a good student, has actually taken a drivers education course or is away at college without an auto, you may additionally get a reduced rate.

The vital to savings is not the discount rates, yet the final cost. A company that uses few discounts might still have a reduced general price. Federal Citizen Info Center National Consumers League Cooperative State Research Study, Education And Learning, and Expansion Solution, USDA.

Other things that may be taken into consideration consist of just how long you have been driving, your driving record, as well as your cases background. Why Rates as well as Quotes May Differ To assist ensure you obtain an exact quote, it is necessary to supply total and also exact details. Imprecise or insufficient info can cause the quote total up to differ from the actual rate for the policy.

If you omit information in the pricing quote process concerning accidents you've been in (even small ones), your plan price may be greater. If you neglect to supply information concerning your considerable others' driving background, such as speeding tickets, this may cause a higher price. Making certain you have the appropriate information can make the procedure of obtaining a quote simpler.

You're sharing the risk with a swimming pool of chauffeurs. Insurance works by moving the risk from you to us, your insurance firm, and also to a large team of other people.

A Biased View of Why Did My Car Insurance Go Up?

Whether you pay your premium month-to-month or every year, the expense of your car insurance deserves paying interest to, as the price can boost for a range of reasons. The national ordinary auto insurance policy costs is $1,555 annually, however you may pay a lot more than that if you live in a high-cost state, have bad credit report or have cases on your driving document.

Initially, it is necessary to recognize why your vehicle insurance policy could be so pricey. A number of elements can influence the price of your plan, some of which remain in your control, while others are past immediate influence. This post explores why cars and truck insurance coverage is so costly as well as what you can do to obtain the most affordable rate.

In other words, there's a whole lot that goes into your rate, so it's challenging to pinpoint one reason that your costs is high."If you're questioning why your vehicle insurance coverage is so pricey, consider both elements within as well as outside of your control. insurance. While you can drive thoroughly, you can't quickly remove mishaps from your driving document.

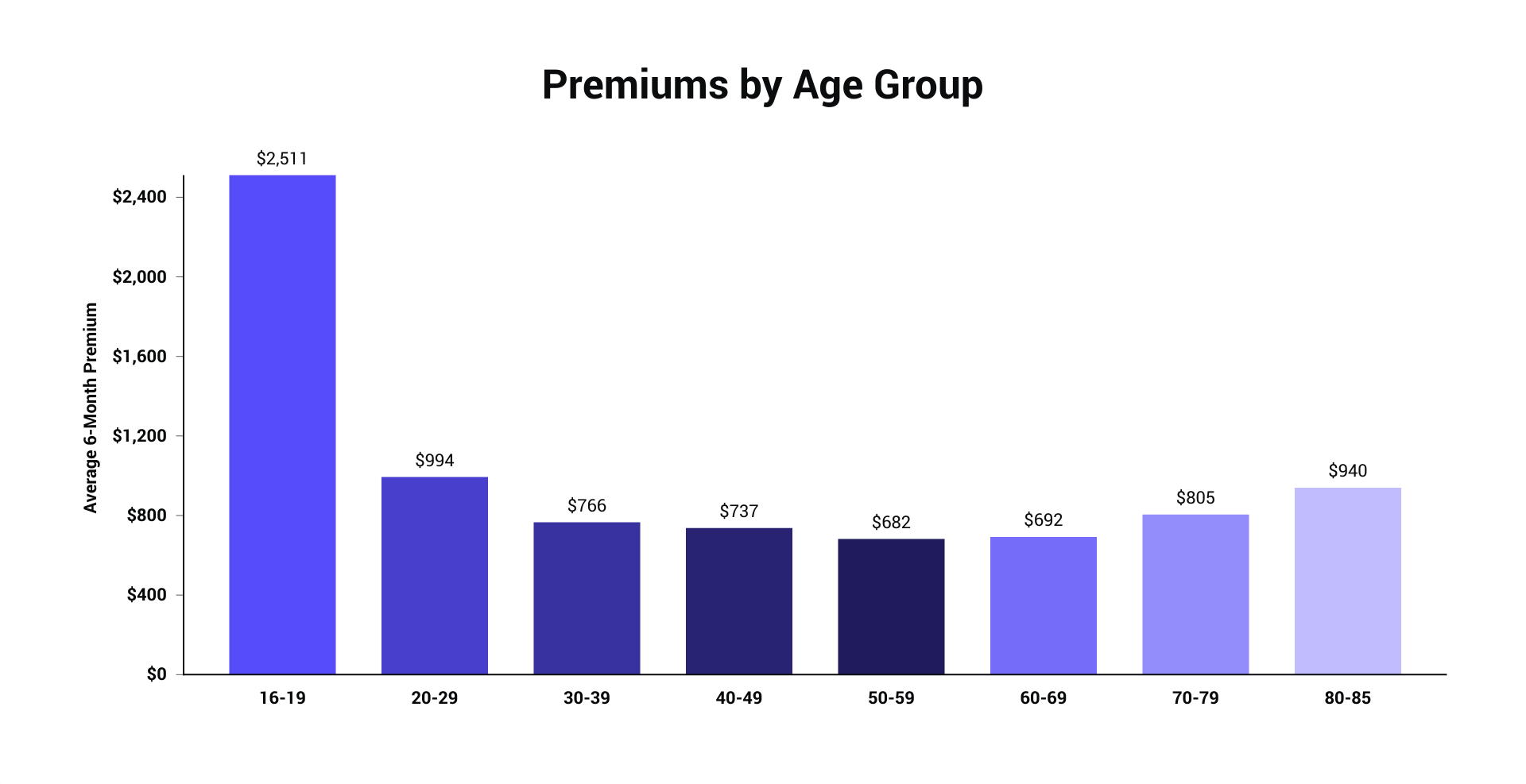

Age, The more youthful you are, the a lot more you'll pay for cars and truck insurance. Insurance policy carriers identify inexperienced motorists as being a statistically-higher risk to insure.

Research shows that adding a teenager driver to your plan causes an typical superior increase of 130%. That means parents are generally in charge of an added $2,300 each year when their teen gets to driving age as well as is added to the policy. Gender, A common myth is that men are riskier to insure as well as incur higher premiums than ladies.

Men pay somewhat less than women each year for obligation protection, while ladies pay somewhat much less than males annually for full protection (insurers). The void is bigger when it pertains to teen chauffeurs, nevertheless, since research reveals that the death price for male teen vehicle drivers is dual that of women teens. State, If your cars and truck insurance policy is as well high, your place might have a great deal to do with it. The ordinary expense of automobile insurance policy varies by state. For example, a complete insurance coverage plan in Maine costs an average of simply $831 a year, while a full insurance coverage plan in Florida would certainly establish you back approximately $2,587 a year.

The 10-Minute Rule for Average Car Insurance Costs In March 2022 - Policygenius

Along with attorney costs and also penalties, you'll go through an typical exceptional increase of $800 if you're caught driving intoxicated. Insurance claims filed, The number of cases you file generally has an impact on prices too, whether mishaps are your fault or not. Usually, a no-fault mishap will cause a 10% increase in your price and remain on your document for 3 years (cheap car).

It's an excellent suggestion to obtain brand-new automobile insurance policy prices quote if there's an adjustment in your rating near the expiry of your existing plan as you might have the ability to protect a lower rate - auto. Other variables, There are a number of various other elements beyond your control that can increase or reduce your cars and truck insurance policy costs.

Your gas mileage will influence your prices in some states even more than others. money.

If your car insurance price is as well high, you may qualify for price cuts that might decrease your yearly costs. If you're questioning why your automobile insurance is so high, know that it's based on a mix of different elements.

If that does not work, think about a pay-as-you-drive program, which can also be a great fit for drivers looking to pay only for the coverage they require on an use basis. auto insurance.

The average driver in the U.S. pays $1,424 each year for a full protection plan with 100/300/100 restrictions. Nonetheless, the expense of auto insurance in New York is a lot higher there, the typical motorist spends $3,433 each year for coverage. The state is rivaled only by Michigan for the most expensive insurance policy premiums in the nation.

The Best Strategy To Use For Why Is Michigan Car Insurance So Expensive?

2% rise in costs over the past six years. Aspects such as high health care prices as well as additional insurance coverage requirements add to why cars and truck insurance policy is so expensive in New York. As a result of this, Cash, Nerd suggests that motorists compare quotes and also search to discover budget-friendly cars and truck insurance in New York.

New York auto insurance rates have enhanced 14. All these contribute to why auto insurance in New York is so pricey.

These extra coverages raise the general price of insurance for vehicle drivers in the state. Pricey Health Care Expenses, Healthcare is pricey throughout the USA, but costs are even higher in New York. According to a 2017 research study performed by the NYS Health And Wellness Structure, New York citizens paid the eighth highest insurance coverage prices in the nation.

Buffalo and Rochester, the 2nd and also third-largest cities in the state, are taken into consideration more secure than just 6% as well as 7% of other cities, specifically. Vehicle Insurance Coverage Rate Increases in New York City, The average cost of vehicle insurance coverage in New York is $3,433 annually or about $286 each month. Cars and truck insurance prices in New York have boosted over the last few years.

2% on average. Just how to Save on Automobile Insurance in New York, While costs might be high in the state, there are several steps you can take to discover reduced rates.

Make sure you ask concerning all insurance needs in New York not simply the common obligation insurance policy, yet PIP as well as without insurance motorist insurance coverage. Cash, Nerd discovered that purchasing several kinds of plans from the exact same service provider might conserve you up to $833 per year.

The smart Trick of What's The Average Cost Of Car Insurance In 2020? - Business ... That Nobody Find more information is Talking About

Auto insurance policy companies supply numerous price cuts. If you have a tidy driving record, ask your service provider concerning safe-driver price cuts. Various other business lower prices for installing safety and security devices in your vehicle. Readily available cost savings differ by state as well as company, so make certain to ask all possible service providers what price cuts you currently certify for.

Motorists throughout the USA that own an automobile are generally required to have a vehicle insurance policy. With the risks you deal with on the road and the monetary factors to consider entailed, the price of insurance coverage is not weighed lightly. Americans spend about $1,674 each year on their vehicle insurance.

Insurance coverage kinds and levels, The quantity of insurance you have as well as the type of protection you acquire greatly influences your price. Every state decides its own demands when it involves the minimal insurance coverage needs on any automobile insurance coverage. vehicle. Some states have extremely basic minimum needs for bodily injury and property damage coverage while various other states might call for additional protections such as without insurance and/or underinsured vehicle drivers and medical payments or injury protection (PIP) protection.

Age, When you are taken into consideration a higher-risk motorist by insurance firms, you commonly face greater insurance policy premiums (suvs). Age is a substantial factor when it pertains to determining your risk because stats reveal that new adolescent chauffeurs are more probable to obtain into an accident as a result of lack of experience. Elderly chauffeurs, particularly those over 80, may additionally be at higher risk of entering into a mishap.

Relatively, drivers in San Francisco might get a reduced price than a person in Los Angeles. Exactly how to lower your automobile insurance policy, Since relocating to another state might not be a feasible financial savings alternative and also you can refrain anything about your age, take into consideration the other elements that go right into identifying your vehicle insurance coverage premium.

Additionally, you can look around at various insurance provider to see which carrier will provide you the very best rate. If you remain in the market for a new auto, you can additionally obtain a quote for a pair various automobiles to see which one might result in the most affordable premium. car.

Little Known Questions About Why Is My Car Insurance So Expensive? - Compare The Market.

Taking the steps to improve your credit rating may all at once boost your insurance coverage premium depending upon your place, your insurance policy business, and exactly how significantly your rating boosts. Car insurance policy business all figure out rates differently so simply due to the fact that one company weighs your credit rating a lot more heavily does not imply that another firm will do the exact same. low cost auto.

Some states use protective driver programs that can restrict the number of factors against your certificate as well as if the course is authorized by your insurer, you may have the ability to decrease your premium. suvs. Furthermore, some companies provide accident forgiveness intends that would keep your auto insurance from going up in case of one accident.

These price variables are based on facets that have actually been revealed to create higher chances of submitting an auto insurance policy claim, not approximate elements. When buying vehicle insurance policy, you are not asked to send the shade of your automobile, so it's not a contributing element.

The state you live in is a huge one - accident.

Chauffeurs age 65 as well as older pay even more than drivers in the 25- to 65-year-old variety due to response time reducing as you get older.: if you stay in a ZIP code that has a high price of vehicle theft, your vehicle insurance coverage prices might increase as a result.: if your neighbors have actually filed lots of vehicle insurance policy asserts in the past, that can equal a high-risk situation as well as higher premiums - business insurance.

Extra cars suggest higher possibilities of a crash. This means higher prices. How to reduce your vehicle insurance coverage price Whether you're checking out high insurance policy rates or otherwise, there are a range of ways via which you can aid lower your expenses. These consist of: Contrast vehicle insurance prices quote A terrific means to conserve money on automobile insurance is to contrast quotes from several car insurance provider.